Elections & Market Movements: What History Tells Us

While elections can stir strong emotions, it's important to remember that, historically, markets have been influenced more by economic fundamentals than by which party is in power.

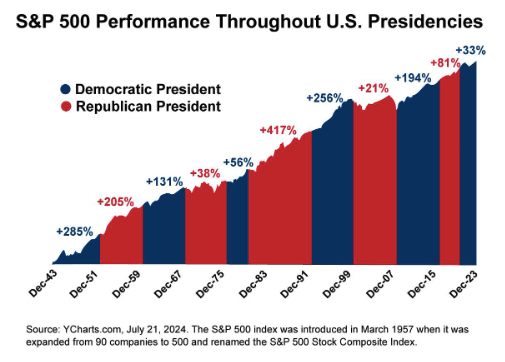

As this chart shows, while the stock market has fluctuated under presidents of both parties, the S&P 500 has trended higher over the long term, no matter who’s sitting in the Oval Office.

Key Takeaways for Investors

- Long-Term Market Resilience: The stock market, as reflected by the S&P 500, has generally trended upward over time, regardless of which party holds the presidency. America’s dynamic economy has produced resilient, thriving companies under administrations of both parties.

- Market Influences Beyond Politics: Factors like earnings growth, economic conditions, and technological innovation can have a much greater impact on market performance than shifts in political leadership.

- Prioritize Your Personal Financial Goals: Your investment strategy should stay aligned with your goals, time horizon, and risk tolerance—not the outcome of a single election.

While elections can bring policy shifts, which may impact areas like tax laws, regulations, or corporate competitiveness, it’s important to maintain perspective. Market reactions to political events often create short-term volatility, but these fluctuations tend to be temporary.

Staying the course and focusing on your long-term financial objectives is key. Acting impulsively in response to transient events can often do more harm than good. We’re here to help you remain grounded and navigate any uncertainties while pursuing your broader financial strategy.

If you have any questions about how current events might affect your investments or would like to review your financial plan, please don’t hesitate to reach out to us.

Stocks are measured by the Standard & Poor's 500 Composite Index, an unmanaged index considered representative of the overall U.S. stock market. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. Stock price returns and principal values will fluctuate as market conditions change. Shares, when sold, may be worth more or less than their original cost.