About Altruist

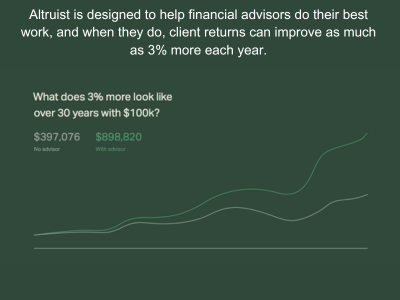

Altruist is an innovative investment management platform that allows us to use best in class portfolio managers to build strategic asset allocations.

What is Altruist?

We use Altruist as our custodian. A custodian is simply a tool to safeguard and hold your assets. We like Altruist because it allows us to execute more nuanced aspects of portfolio management (automated investing, tax loss harvesting, rebalancing, portfolio construction based on goals, backdoor Roths, Roth conversions, and more!)

Altruist is a member of SIPC and the fourth largest of the custodians by client number. The general public cannot open accounts on the platform because you have to work with a financial advisor for access.

What are the advantages of using Altruist?

- Low Cost. The majority of portfolios cost 12 basis points or .12% or .0012 per year.

- Earn more with your cash! Your partnership with Advisor gives you access to the Altruist Cash Account with an impressive 4% Annual Percentage Yield (APY).

- Access to 30 top tier investment managers including BlackRock, Goldman Sachs, Vanguard, State Street and more added every month.

- Modern Investing Capabilities. Altruist is 100% digital. Create your account, make deposits and withdrawals, and keep track of your investments all within their easy to use interface and mobile app.

- More Efficient Investing. With access to commission-free fractional shares, we can invest your money in high-quality assets, no matter the size of your account.

- Automation. Implementing a rebalancing software ensures none of your holdings go over or below a percentage of what the allocation is.

- Easy to use. Whether viewing your accounts on your desktop computer, or Android or iPhone, you can quickly access real-time performance, portfolio characteristics, and important documents.

- Remove the stress of managing your own investments. Leave it to the experts. We'll design a portfolio suited to you and your goals using low cost ETFs.

- Cohesive distribution strategy. Whatever the distribution cadence is (monthly, quarterly, etc), we are able to efficiently sell across the portfolio rather than from one holding.

- Tax Loss Harvesting. Through Altruist we are able to implement tax strategies that

sells investments that have gone down in value to help reduce your tax bill, then reinvests the money in similar assets to keep your overall investment strategy on track.

Additional Information About Altruist

FAQs

Do I have to sign up for Altruist?

No. However, to get the most value from your relationship with Advisor Wealth Management, you should take advantage of professional portfolio management through Altruist.

Keep in mind that managing your assets is not how Advisor gets paid. If you are a DIY investor, our team can help design your portfolio, but you will have to handle the buying, selling, distributions, rebalances, etc.

What fees are you charging to my Altruist accounts?

No fees are paid to Advisor Wealth Management. We believe in flat-fee financial advisory services, and professional portfolio management is included in your subscription fee.

These portfolios cost 12 basis points or .12% or .0012 per year. This is below the industry standard, and is deducted from your portfolio and paid to the money manager, not Advisor Wealth Management.

What happens to my accounts if I leave Advisor?

We strive to build long lasting relationships and hope you never leave! However, these are your accounts and should you ever decide to leave Advisor, they are easily transferred out to a custodian of your choosing.